The RF Securities Industry Regulation tackles prosecutorial misconduct and ethical violations to uphold financial sector integrity. It aims to prevent and penalize fraudulent activities like insider trading and misuse of client funds, ensuring fair markets and investor protection. Recent cases highlight a trend of excessive sentencing and improper evidence handling, emphasizing the need for regulatory vigilance to restore public trust. Effective strategies include enhanced data analytics, collaborative intelligence sharing, and stringent compliance programs to deter violations and promote ethical conduct within the industry.

The RF Securities Industry Regulation is a complex web of laws and guidelines governing financial markets. This article delves into the critical aspects of this regulation, focusing on understanding the framework that ensures accountability. We explore the pressing issue of prosecutorial misconduct within financial enforcement, highlighting ethical failures that undermine market integrity. Furthermore, we present strategies to address violations, emphasizing the importance of regulatory transparency and integrity for a robust securities industry. Key topics include enhancing oversight and accountability mechanisms to prevent ethical violations in financial sectors.

- Understanding RF Securities Industry Regulation: A Framework for Accountability

- Prosecutorial Misconduct: Uncovering Ethical Failures in Financial Enforcement

- Addressing Violations: Strategies for Strengthening Regulatory Integrity and Transparency

Understanding RF Securities Industry Regulation: A Framework for Accountability

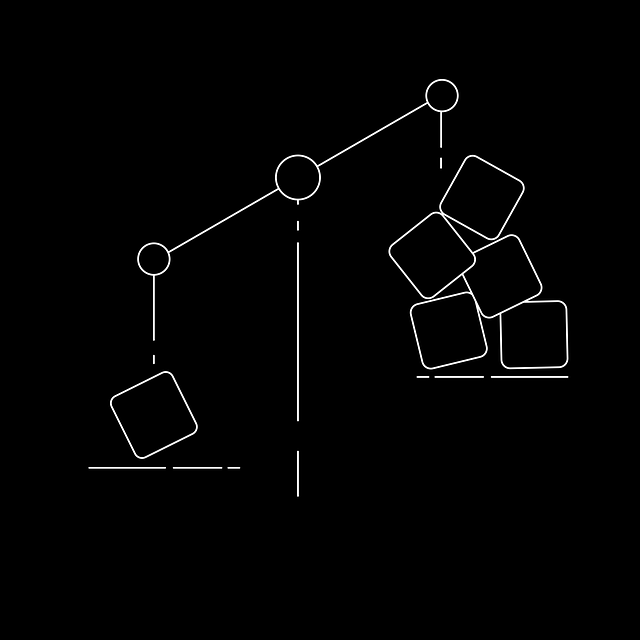

The RF Securities Industry Regulation is a complex framework designed to hold financial institutions and professionals accountable for their actions. At its core, this regulation aims to prevent and punish instances of prosecutorial misconduct and ethical violations within the industry. These violations can range from fraud and insider trading to misuse of client funds and breach of fiduciary duty. Understanding the regulatory landscape is crucial for both regulators and industry participants to ensure fair markets and protect investors.

One significant aspect of this regulation involves judicial oversight through jury trials, which offer a transparent and accountable mechanism for resolving disputes. In cases where prosecutors act unethically or improperly, for his clients or otherwise, avoiding indictment becomes a strategic consideration. However, the regulatory framework also encourages proactive compliance measures to mitigate risks, fostering an environment where ethical conduct is the norm rather than the exception.

Prosecutorial Misconduct: Uncovering Ethical Failures in Financial Enforcement

In the realm of financial enforcement, an unexpected twist often emerges from the shadows—prosecutorial misconduct. This phenomenon, where legal professionals stray from ethical boundaries, has far-reaching implications for the RF Securities Industry. Uncovering instances of prosecutorial misconduct is akin to weaving through a complex tapestry of white collar and economic crimes, revealing not only individual failures but also systemic issues within the justice system. When prosecutors cross the line, it shatters the public’s trust and undermines the integrity of financial regulations.

An analysis of recent cases highlights an unprecedented track record of ethical violations. From excessive sentencing to improper handling of evidence, these misconducts impact both corporate and individual clients. The consequences are profound, as they erode the fairness and equality that should underpin financial enforcement. As a result, regulatory bodies must remain vigilant, ensuring that such misconduct is not just addressed but also deterred, fostering a culture of accountability and upholding justice in the securities industry.

Addressing Violations: Strategies for Strengthening Regulatory Integrity and Transparency

Addressing violations in the RF securities industry is paramount to maintaining regulatory integrity and transparency. Strategies should focus on strengthening oversight mechanisms to detect and prevent prosecutorial misconduct and ethical violations, which have tarnished the industry’s reputation in the past. One effective approach involves enhancing data analytics capabilities to identify patterns and anomalies indicative of unethical practices. This can include scrutinizing trading activities for unusual volume spikes or price manipulations that may signal insider trading or market manipulation.

Additionally, fostering collaboration between regulatory bodies, law enforcement agencies, and financial institutions is crucial. Such partnerships enable the sharing of intelligence and resources, leading to more robust investigations and stricter penalties for offenders. Moreover, promoting a culture of accountability among industry professionals can significantly deter violations. This involves stringent compliance programs, regular training on ethical conduct, and transparent reporting mechanisms that encourage employees to report misconduct without fear of retaliation, ensuring an unprecedented track record of regulatory adherence and integrity.

The regulation of the RF securities industry is a complex yet essential aspect of maintaining market integrity. By understanding the framework outlined in this article, we can address critical issues such as prosecutorial misconduct and ethical violations within financial enforcement. Strengthening regulatory integrity and transparency through effective strategies is vital to fostering a fair and robust securities marketplace. Recognizing and rectifying violations are key steps towards revolutionizing industry standards and ensuring accountability for all participants.